When your insurance plan drops your medication from coverage or pushes it to a higher cost tier, it’s not just a paperwork issue-it’s a health risk. In 2024, formulary changes affected over 34% of Medicare beneficiaries and nearly 1 in 5 commercially insured patients, often without enough warning. For someone managing chronic conditions like diabetes, rheumatoid arthritis, or Crohn’s disease, a sudden shift in coverage can mean choosing between rent and refills. Understanding how formularies work-and how to respond when they change-isn’t optional. It’s essential.

What Is a Formulary, Really?

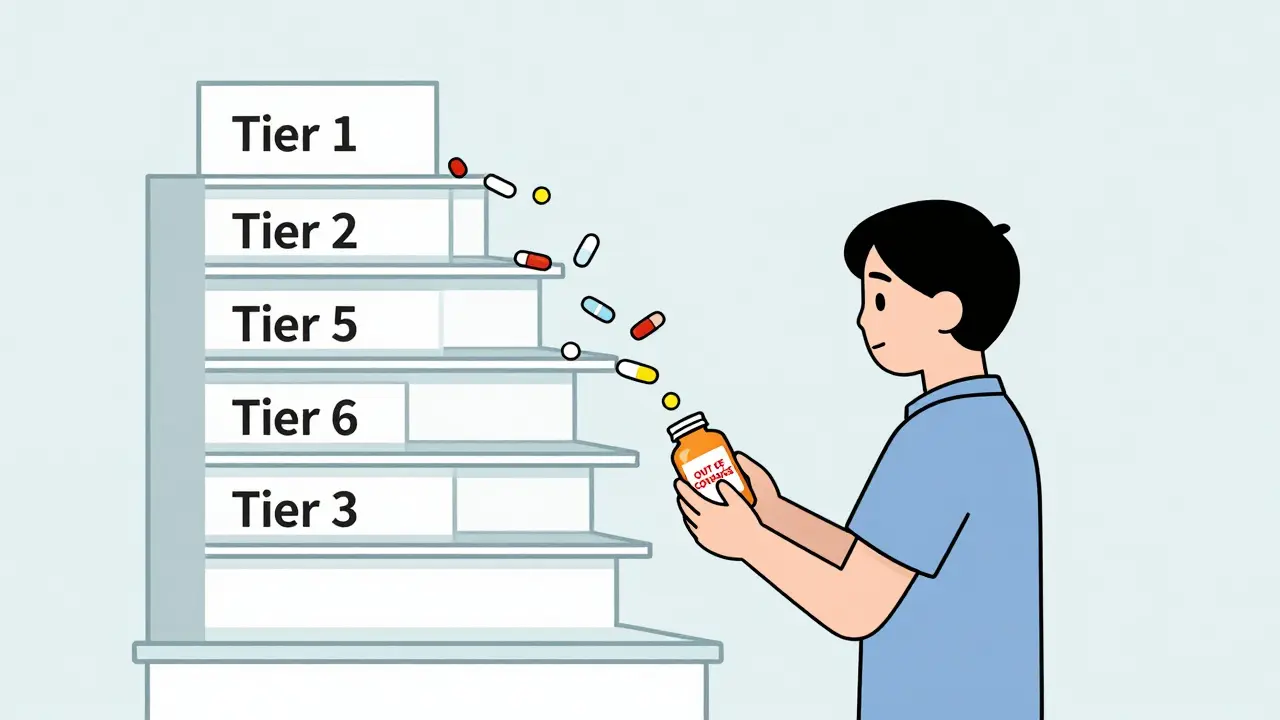

A formulary is simply the list of drugs your insurance plan will pay for. But it’s not just a catalog. It’s a tiered system that decides how much you pay out of pocket. Most plans use 3 to 6 tiers:

- Tier 1: Generic drugs-lowest cost, often $5-$15 per prescription.

- Tier 2: Preferred brand-name drugs-slightly more, usually $30-$60.

- Tier 3: Non-preferred brands-higher cost, $70-$150.

- Tier 4-6: Specialty drugs-like Humira or Enbrel-can cost $300-$1,000+ per month.

Over 90% of Medicare Part D plans and 87% of commercial plans use this tiered structure. The goal? Keep costs down for the insurer. The unintended consequence? Patients abandon prescriptions when their favorite drug moves from Tier 2 to Tier 3. A 2023 GoodRx study found that 47% of patients stopped taking their medication after such a shift. For diabetes drugs, that number jumped to 58%.

Why Do Formularies Change?

Formularies aren’t static. They’re reviewed quarterly by Pharmacy and Therapeutics (P&T) committees-groups of doctors, pharmacists, and sometimes patient reps-who evaluate new drugs, rebates, and clinical data. Here’s what triggers a change:

- A new generic hits the market-your brand-name drug gets bumped down to make room.

- A manufacturer raises its price-your insurer drops it to avoid higher costs.

- A competitor drug offers better outcomes or lower cost-your plan switches.

- A rebate deal expires-your drug loses its preferred status.

In 2024, 78% of large pharmacy benefit managers (PBMs) conducted formal reviews every three months. That means your medication could be removed at any time, even mid-year. And while Medicare plans must give you 60 days’ notice, commercial insurers often give as little as 22 days. That’s barely enough time to react.

How Formulary Changes Hit Real People

Take Sarah, a 62-year-old with rheumatoid arthritis. Her plan covered Humira on Tier 2 for $50/month. In January 2025, her insurer moved it to Tier 5-specialty tier-with 33% coinsurance. Her monthly cost jumped from $50 to $650. She couldn’t afford it. She called her doctor. Her clinic had a formulary alert system-they’d been notified 60 days in advance. They switched her to a biosimilar, which was still covered on Tier 2. She kept her treatment. No hospital visits. No flare-ups.

But not everyone has that luck. On Reddit, users like ‘ChronicCareWarrior’ shared stories of being blindsided: “I’d been on my drug for 7 years. One day, I walked into the pharmacy and got hit with a $650 bill. I had to fight for 3 weeks just to get temporary coverage.” That’s not rare. A 2024 CAQH Index found that 57% of patients received no clear notice before their drug was removed.

What You Can Do When Your Drug Is Removed

If your medication is taken off your plan’s formulary, you have options. Don’t panic. Don’t stop taking it. Act.

- Check your plan’s formulary tool. Most insurers have a searchable online formulary. Type in your drug’s name. If it’s gone, note the date it was removed.

- Ask your doctor about alternatives. Not all drugs are created equal. There may be another in the same class that’s still covered. For example, if your blood pressure med was dropped, there are often 6-8 other generics available.

- Request a formulary exception. This is a formal appeal. You need a letter from your doctor saying the drug is medically necessary. For Medicare, 64% of these requests are approved when supported by clinical evidence. Submit it within 15 business days of notification.

- Use manufacturer assistance programs. Many drug makers offer copay cards or free medication for eligible patients. In 2024, these programs covered over $6 billion in patient costs.

- Switch plans during open enrollment. If you’re on Medicare, use the Plan Finder tool. Compare formularies across plans. Look for one that covers your drugs on lower tiers.

Pro tip: If you’re on a chronic condition, ask your pharmacy to set up a formulary alert. Many pharmacies now track changes and notify patients before their next refill.

How Providers Can Help

Doctors and clinics aren’t just bystanders-they’re frontline defenders. Large medical groups with 76% adoption of e-prescribing systems now check formulary status in real time when writing prescriptions. That means if your drug is no longer covered, your doctor sees it before you even walk to the pharmacy.

Best practice? Ask your provider: “Do you check formulary status before prescribing?” If they say no, request it. You’re not being difficult-you’re being proactive.

What’s Changing in 2025

The rules are shifting. Starting January 1, 2025:

- Medicare beneficiaries will pay no more than $2,000 per year out of pocket for drugs-no matter how many tiers they’re on.

- All Medicare Part D plans must standardize how they handle formulary exceptions.

- Accumulator adjustment programs (which prevent manufacturer coupons from counting toward your deductible) will be limited in Medicare plans.

These changes will reduce financial shock for many. But they also mean insurers will become more aggressive about steering patients to lower-cost drugs. That’s why staying informed matters more than ever.

How to Stay Ahead of Changes

You can’t stop formulary changes. But you can prepare for them.

- Review your formulary every fall. Annual enrollment is your best chance to switch plans before changes hit.

- Keep a list of your medications. Include dosage, brand, and generic name. Update it every time you refill.

- Use free tools. Medicare’s Plan Finder, GoodRx, and your insurer’s formulary lookup are all free. Use them.

- Ask your pharmacist. They see formulary updates before you do. Ask: “Is my drug still covered?”

- Know your rights. Medicare must give you 60 days’ notice. Commercial plans? Not always. But if you’re on a long-term medication, you may qualify for a transition supply-usually 30-60 days’ worth-to avoid interruption.

Remember: Formularies exist to control costs. But they shouldn’t control your health. If your drug is taken off your plan, you have power. Use it.

What should I do if my medication is removed from my formulary?

First, don’t stop taking your medication. Contact your doctor to ask about alternatives or request a formulary exception. Submit the exception request within 15 business days. Check if your drug manufacturer offers patient assistance programs. If you’re on Medicare, use the Plan Finder to compare other plans that cover your drug. For commercial insurance, call your plan’s member services to confirm the change and ask about transition supplies.

How much notice do I get before a formulary change?

Medicare Part D plans must give you at least 60 days’ notice for non-urgent changes. Commercial insurers are not required to give advance notice, but many do-typically 22 to 30 days. Always check your plan’s website or call member services if you suspect a change. Some pharmacies now send alerts when your drug is about to be removed.

Can I appeal a formulary decision?

Yes. You can request a formulary exception by submitting a letter from your doctor explaining why you need the drug. For Medicare, 64% of these requests are approved when supported by clinical evidence. You can also appeal if your request is denied. Medicare beneficiaries can get free help from State Health Insurance Assistance Programs (SHIP). Commercial plan members should review their plan’s appeals process-usually outlined in their member handbook.

Are there cheaper alternatives if my drug is removed?

Often, yes. For most conditions-like high blood pressure, diabetes, or depression-there are multiple drugs in the same class. Your doctor can switch you to a generic or preferred brand. For example, if your insulin is removed, there are often 3-5 other insulins covered on lower tiers. Don’t assume you have no options. Ask your pharmacist or doctor for alternatives before assuming you must pay full price.

Do manufacturer coupons help if my drug is removed from the formulary?

Not always. Many insurers now use accumulator adjustment programs, which means manufacturer coupons don’t count toward your deductible or out-of-pocket maximum. If your drug is removed, coupons won’t help you get it covered. Instead, focus on manufacturer patient assistance programs-these often provide free medication to eligible patients. You can find these through the drugmaker’s website or organizations like NeedyMeds.org.

Coy Huffman

February 4, 2026 AT 18:28