Every year, hundreds of life-saving drugs vanish from hospital shelves. Not because they’re no longer needed, but because the system that makes and moves them is brittle. In 2022 alone, the U.S. faced 245 drug shortages-62% of them sterile injectables used in emergency rooms, ICUs, and during surgery. These aren’t minor inconveniences. They’re emergencies. A shortage of epinephrine can delay cardiac arrest treatment. A lack of sodium bicarbonate can turn a routine dialysis session deadly. And behind every shortage is a broken supply chain that prioritized cheapness over safety.

Why the Drug Supply Is So Fragile

For decades, pharmaceutical companies chased efficiency. They cut costs by moving manufacturing overseas, relying on single suppliers, and keeping inventory so lean it barely touched the floor. It worked-until it didn’t. When the pandemic hit, global lockdowns, port delays, and raw material shortages exposed how thin the margins really were. Today, 72% of active pharmaceutical ingredients (APIs) for U.S. drugs come from outside the country, with nearly half coming from just two nations: China and India. That’s not diversity. That’s dependency.And it’s not just geography. Most companies don’t even know where their raw materials come from. Only 12% have visibility past three layers of suppliers. That means if a mine in Kazakhstan stops producing a key chemical, or a factory in Bengaluru gets hit by a flood, the company making your blood pressure pill might not find out until it’s too late.

What Resilience Actually Looks Like

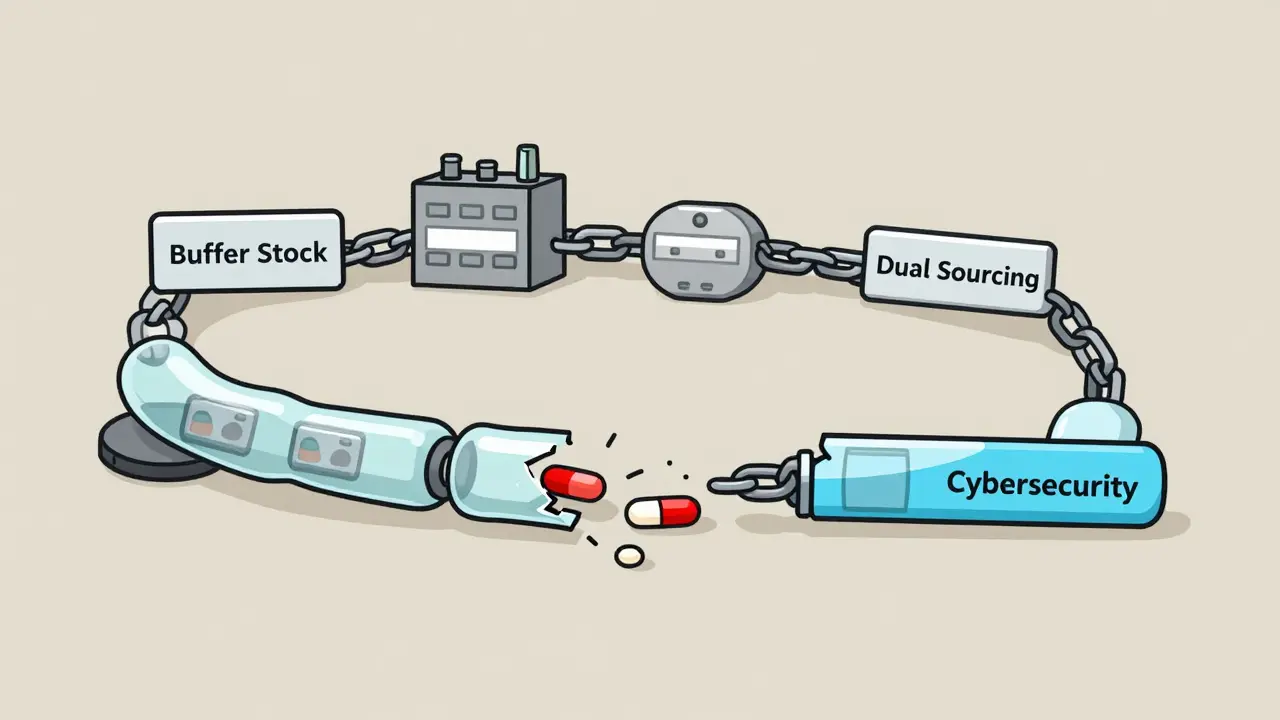

Building resilience isn’t about hoarding pills in a warehouse. It’s about redesigning the entire system so it can bend without breaking. Experts agree: there’s no silver bullet. But there are proven strategies that work together.Buffer stockpiles are one of the simplest fixes. For critical medicines like insulin, antibiotics, and anesthetics, keeping 6 to 12 months of supply on hand can prevent a crisis from becoming a catastrophe. It sounds expensive, but it’s cheaper than the alternative. Stockpiling alone would cost $3.5-4.2 billion a year-but it only prevents about 45% of shortages. That’s why it’s just one piece.

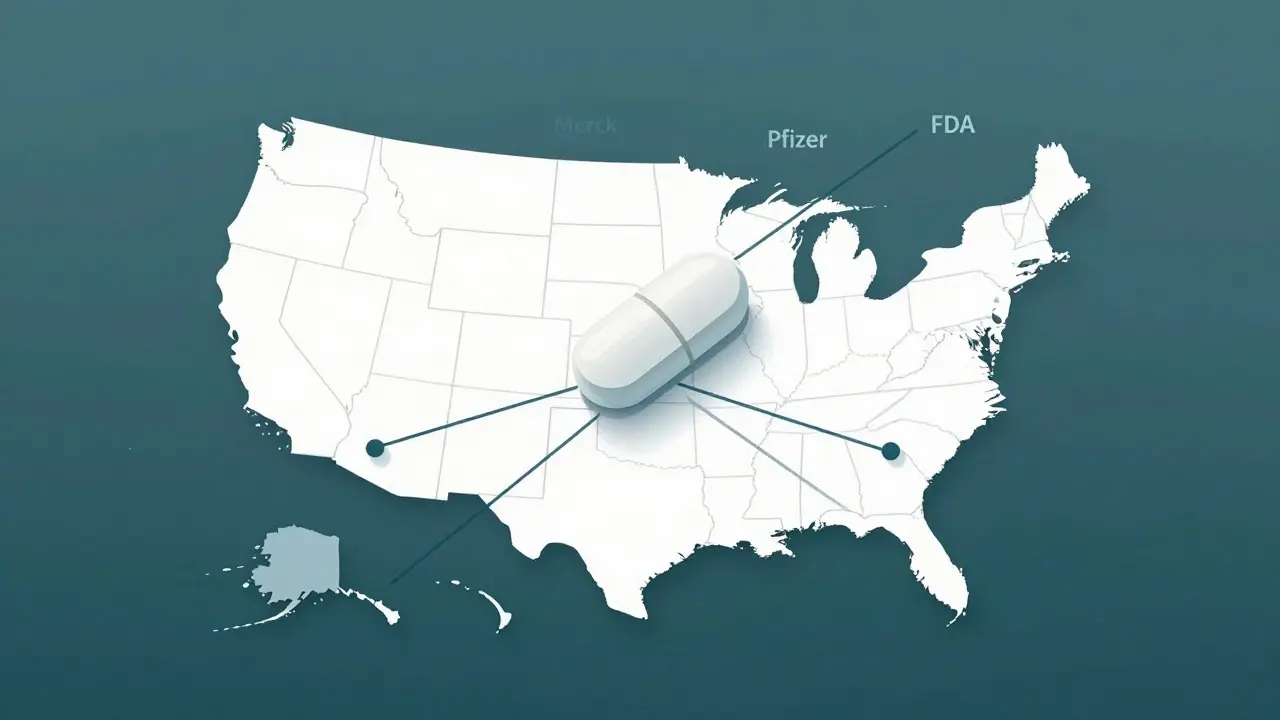

Supplier diversification is the next layer. Instead of relying on one factory in one country, manufacturers need at least three suppliers spread across different regions. For the most vital drugs, having dual sourcing for 80% of the API volume cuts disruption risk by over half. Merck did this for 12 key antibiotics after federal incentives helped cover $85 million in new domestic production costs. The result? 95% of those drugs are now made in the U.S.

Manufacturing redundancy means having the same drug produced in multiple locations using the same formula. This isn’t about duplication-it’s about insurance. If one plant shuts down due to a cyberattack or regulatory issue, another can pick up the load. Pfizer invested $220 million in AI-driven demand forecasting across 150 distribution centers and slashed stockouts by 38%. That’s not magic. That’s data.

The Hidden Threat: Cyberattacks on Drug Supply Chains

Most people don’t realize that the biggest new threat to drug availability isn’t a natural disaster-it’s a hacker. Between 2020 and 2023, cyberattacks on healthcare supply chains jumped 214%. A single ransomware attack can shut down a manufacturing line for weeks. In 2022, a major distributor lost access to its inventory system for 11 days. No one knew where drugs were, who had them, or when they’d arrive. Hospitals scrambled. Patients waited.That’s why cybersecurity is now part of supply chain resilience. The Healthcare Distribution Alliance says coordinated threat intelligence sharing cuts response time by 47%. Companies using the NIST Cybersecurity Framework across all partners are far less likely to face catastrophic outages. This isn’t IT’s problem. It’s a patient safety issue.

Costs vs. Consequences

Some say these fixes are too expensive. But what’s the real cost of a shortage?In 2023, the U.S. healthcare system spent $216 million extra because of drug shortages-paying more for alternatives, rushing shipments, extending hospital stays, and hiring temporary staff. That’s not a cost of resilience. That’s the cost of doing nothing.

Reshoring all API production would add 25-40% to drug prices. That’s steep. But a hybrid model-keeping the most critical drugs made domestically while diversifying elsewhere-costs just $1.2-1.8 billion a year and prevents 85% of shortages. That’s a 9:1 return on investment when you count avoided hospital costs and lives saved.

And here’s the kicker: supply chain mapping technology, which gives companies full visibility into their suppliers, costs only 8% of total resilience spending-but cuts disruptions by 32%. That’s the smartest buy in the whole system.

Regulations Are Catching Up

The government is finally stepping in. The FDA’s Drug Supply Chain Security Act (DSCSA) now requires full electronic tracking of every drug package by 2024. That means every pill can be traced from raw material to pharmacy. It’s a massive shift-and it’s long overdue.The HHS 2024 Resilience Implementation Plan is allocating $520 million to build domestic capacity for 50 critical medicines, aiming for 40% of those APIs to be made in the U.S. by 2027. Meanwhile, the FDA’s new draft guidance requires manufacturers to conduct annual vulnerability assessments starting in Q3 2025. No more guessing. No more excuses.

Even Medicare is getting involved. A proposed 2024 rule would tie reimbursement rates to how transparent a drug’s supply chain is. If you can’t show where your ingredients come from, you get paid less. That’s a powerful incentive.

What’s Holding Us Back?

The biggest barriers aren’t technical-they’re human.Most companies still use outdated, incompatible software systems. 78% report data silos between suppliers, manufacturers, and distributors. That makes real-time risk tracking impossible.

There’s also a skills gap. Only 35% of pharmaceutical firms have staff trained in supply chain risk analytics. By 2027, the industry will need 125,000 more specialists just to keep up.

And then there’s procurement. 67% of manufacturers say their buyers are still choosing suppliers based on the lowest price-not reliability, not quality, not resilience. That’s like choosing a car based only on sticker price and ignoring the safety rating.

The Path Forward

Resilience isn’t a project. It’s a culture. It’s built over time, with clear steps:- Map your chain-know every supplier, down to the raw material source.

- Assess your risks-which drugs are most critical? Which suppliers are most vulnerable?

- Act strategically-combine stockpiles, dual sourcing, and domestic capacity where it matters most.

- Secure your systems-apply cybersecurity standards across every partner.

- Measure and adapt-track disruptions, learn, and improve every year.

It’s not easy. But the alternative-waiting for the next shortage to hit-is far worse. Every hospital, every pharmacy, every patient deserves a supply chain that doesn’t break under pressure. We know how to fix this. Now we just need to do it.

What Comes Next

By 2030, experts project that with full implementation of these strategies, critical drug shortages could drop by 75%. That’s not a dream. It’s a calculation. It’s based on real data, real investments, and real-world results.The question isn’t whether we can afford to build resilience. It’s whether we can afford not to.

What causes most drug shortages today?

Most shortages today stem from supply chain fragility-not lack of demand. Over 60% are tied to manufacturing disruptions, especially in overseas facilities that produce active pharmaceutical ingredients (APIs). Other top causes include raw material shortages, regulatory delays, quality control failures, and cyberattacks. Just 12% are due to actual production capacity limits.

Is stockpiling drugs a good long-term solution?

Stockpiling helps in emergencies but isn’t enough on its own. It prevents about 45% of shortages and costs $3.5-4.2 billion annually. The smarter approach combines stockpiles with supplier diversification, manufacturing redundancy, and demand forecasting. For critical drugs like injectables, 6-12 months of buffer stock is recommended-but only when paired with other resilience tools.

Why isn’t all drug manufacturing done in the U.S.?

It’s mostly about cost. Manufacturing APIs domestically can increase prices by 25-40%. Many companies outsourced production decades ago to cut expenses. But reshoring is happening for high-risk drugs-like antibiotics and anesthetics-where the consequences of shortage outweigh the cost. Federal incentives are helping, but full reshoring isn’t economically feasible for all drugs. A hybrid model is more realistic.

How does cybersecurity affect drug availability?

Cyberattacks can shut down manufacturing, disrupt logistics, and erase inventory records. Between 2020 and 2023, attacks on pharmaceutical supply chains rose 214%. A single ransomware incident can delay shipments for weeks. Companies using the NIST Cybersecurity Framework across their entire supply chain reduce disruption risk by up to 60%. Cyber resilience is now as vital as raw material access.

Are generic drugs more vulnerable to shortages?

Yes. Generic drugs often have thinner profit margins, so manufacturers are less likely to invest in backup suppliers or inventory. Over 70% of shortages involve generics, especially sterile injectables. The same active ingredient might be made by five companies-but if four rely on the same API supplier in one country, all five are at risk. Diversification is critical, even for low-cost drugs.

What can hospitals do right now to prepare?

Hospitals should prioritize critical drugs-like those used in emergencies-and work with distributors to identify alternative formulations. They should also track usage patterns and report shortages to the FDA. Formulary adjustments, conservation protocols, and real-time inventory monitoring can stretch supplies during crises. But long-term, hospitals need to push manufacturers and policymakers for systemic change-not just temporary fixes.

Layla Anna

January 1, 2026 AT 10:36