Every time you fill a prescription for a generic drug, there’s a behind-the-scenes decision that made it possible. It wasn’t random. It wasn’t just about price. Insurers don’t randomly pick which generics to cover-they follow a strict, data-driven system designed to save money without sacrificing care. And if you’ve ever been denied a medication or surprised by a copay, you’ve felt the impact of that system.

How Formularies Work

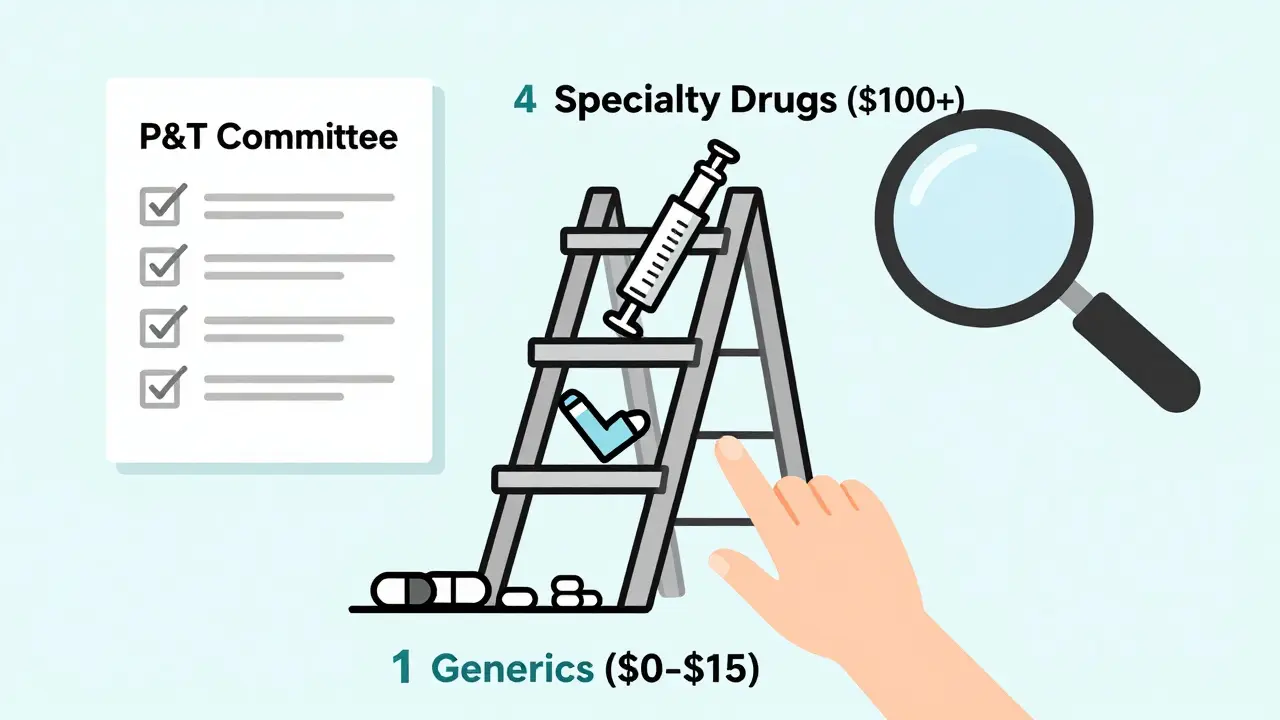

Insurance companies organize drugs into tiers. Think of it like a pricing ladder. At the bottom is Tier 1: generic drugs. These are the cheapest. Above them are preferred brand-name drugs, non-preferred brands, and then specialty drugs-each with higher costs for you. The goal? Keep your out-of-pocket costs low by steering you toward the most affordable options that still work. In 2023, 92% of Medicare Part D plans put all generics in Tier 1. That’s not a coincidence. It’s policy. The average copay for a 30-day supply of a Tier 1 generic? Between $0 and $15. Compare that to $40-$100+ for brand-name drugs. That’s why insurers push generics: they save money, and they’re just as effective. The FDA says generics must have the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They’re not copies-they’re exact chemical matches. But insurers don’t just trust that. They rely on something called the Pharmacy & Therapeutics (P&T) committee.The P&T Committee: The Real Decision-Makers

Every major insurer-whether it’s UnitedHealthcare, Cigna, or a small regional plan-has a P&T committee. These aren’t marketing teams. They’re groups of doctors, pharmacists, and health economists who meet regularly to review drugs. Their job? Decide what goes on the formulary. They look at three things:- Clinical effectiveness: Does it work? Studies show whether it controls blood pressure, lowers cholesterol, or manages diabetes as well as the brand.

- Safety: What’s the side effect profile? Has it been used safely in thousands of patients over years?

- Cos-effectiveness: If two generics do the same thing, but one costs 30% less, the cheaper one wins.

Why Some Generics Get Left Out

Not every generic gets covered. Why? Sometimes it’s because there’s no need. If three generics for lisinopril are already on the formulary and one is priced 5% higher with no proven benefit, it won’t make the cut. Insurers don’t want redundancy-they want efficiency. Another reason: timing. A new generic might be approved by the FDA, but it can take months for a P&T committee to review it. Some insurers wait until there’s enough real-world usage data before adding it. That’s not bureaucracy-it’s caution. They’ve seen cases where a generic looked identical on paper but caused unexpected reactions in certain patient groups. And then there’s the issue of complex generics. Think inhalers, insulin pens, or injectables. These aren’t simple pills. They’re harder to copy. The FDA is working to speed up approvals for these, but right now, insurers are slow to cover them because the evidence is still limited.What Happens When Your Generic Isn’t Covered

If your doctor prescribes a generic that’s not on your plan’s formulary, you’re not stuck. You can file an exception request. This isn’t a long, drawn-out process. Under Medicare rules, insurers have to respond within three business days. For urgent cases-like if you’re at risk of hospitalization-they must respond in one day. To get approval, you need documentation. Your doctor has to explain why:- The covered generic caused side effects

- A similar drug didn’t work for you

- You need a higher dose than the plan allows

Therapeutic Substitution: When the Pharmacist Switches Your Drug

Here’s something most patients don’t realize: your pharmacist can legally swap your brand-name drug for a generic-even if your doctor didn’t prescribe it. This is called therapeutic substitution. In 78% of commercial insurance plans, pharmacists are allowed to do this at the counter. But in Medicare Advantage plans? Only 52% allow it. Why the difference? Medicare plans are more restrictive by design. The problem? Not all generics are created equal in practice. A 2023 survey in Drug Topics found that 31% of patients reported side effects after switching to a different generic version-even though both were FDA-approved. For some people, the inactive ingredients (like fillers or dyes) trigger reactions. That’s why doctors sometimes write “dispense as written” on prescriptions. It’s their way of saying: don’t substitute.

Crystal August

January 20, 2026 AT 11:36